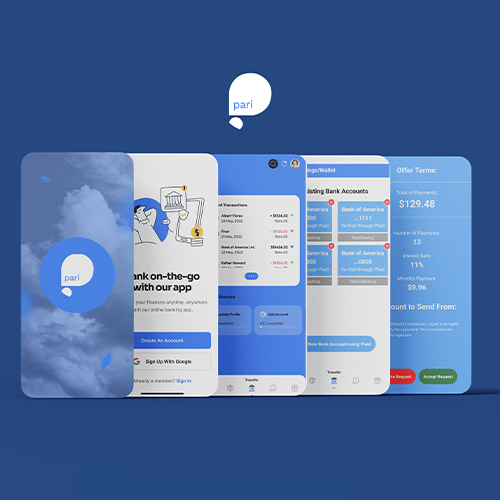

Pari App – Use Case

Challenges Faced

Managing personal loans and borrowings is often a manual, error-prone process. Users typically rely on notebooks, spreadsheets, or memory, which leads to confusion and disputes. The main challenges were:

- No structured systemto track borrowed or lent money.

- Difficulty setting remindersfor repayment deadlines.

- Lack of transparencybetween lenders and borrowers.

- Poor record-keeping, often resulting in forgotten transactions.

- Limited financial awareness, making it harder to track balances.

Solutions We Proposed

We built the Pari App, a simple and intuitive loan & borrowing management application. The app enables users to keep track of financial exchanges with friends, family, or peers in an organized way. Key features included:

- Digital loan trackingfor both lent and borrowed amounts.

- Reminders & notificationsto ensure timely repayments.

- Lending historieswith complete transaction records.

- User-friendly interfaceto make recording transactions simple.

- Secure financial data storagewith Firebase integration.

- Square Payment Gateway integrationfor seamless digital payments.

Workflow

- Add Transaction– Users record whether they are lending or borrowing money.

- Set Reminders– Due dates and alerts ensure repayment isn’t forgotten.

- Manage History– Full loan/borrow records are stored for future reference.

- Payment Integration– Users can repay directly through Square Gateway.

- Notifications– Alerts keep both parties informed about pending amounts.

Project Info

- Category: IT Technology

- Location: Usa

- Completed Date: 2018